Shareholders' Digest

Today: January 15, 2026

subscribe

Thank you for subscribing.

We have sent you a verification email, please check your inbox.

SHAREHOLDERS' DIGEST

Financial news and analysis digest for shareholders · Since 2026

February 14, 2025 • Invest • Risk Management • 4 mins read

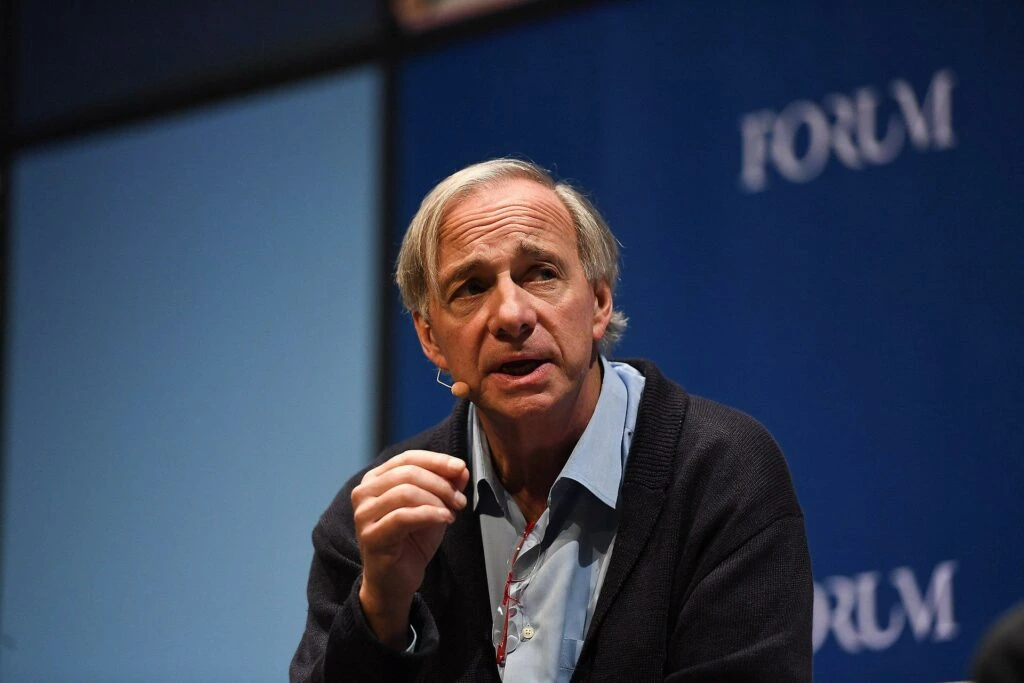

Ray Dalio on Market Cycles, Debt, and Risk Management

Ray Dalio doesn't try to predict the market's next move. Instead, he studies history. As the founder of Bridgewater Associates, his approach is built around understanding long-term economic cycles and preparing for inevitable market turns.

Ray Dalio, founder of Bridgewater Associates, discusses economic cycles and risk management at a financial conference.

He believes that markets behave in patterns — especially during periods of rising debt, tightening credit, and policy intervention. These patterns repeat because, as Dalio says, "human nature doesn't change."

Dalio often points to past financial crises to explain present risks. While circumstances change, the forces behind booms and busts tend to repeat. His study of 500 years of economic history reveals remarkably consistent patterns.

Core Investment Principles: Understanding vs. Predicting

"History repeats itself because human nature doesn't change. The patterns of booms and busts are remarkably consistent over centuries."

— Ray Dalio, Bridgewater Associates Founder

Understanding Economic Cycles and Risk Management

Risk Over Return Focus

Rather than chasing returns, Dalio focuses on avoiding major losses. That mindset has shaped how institutions think about risk management. The "All Weather" portfolio strategy exemplifies this approach.

Preparation Over Prediction

Dalio's work reminds investors that preparation matters more than prediction. Understanding cycles can help avoid costly mistakes when markets turn. His framework emphasizes being prepared for different economic environments.

The All Weather Strategy

His "All Weather" portfolio strategy is designed to perform well across different economic environments — inflation, deflation, growth, and recession. This approach emphasizes diversification across asset classes with low correlation to each other.

Philosophical Approach to Investing

Dalio's principles-based approach to investing emphasizes radical transparency and meaningful relationships. Bridgewater's unique culture of "idea meritocracy" encourages challenging assumptions and finding the best ideas through thoughtful disagreement.

"The biggest mistake investors make is believing what happened in the recent past is likely to persist. They assume the good times will keep going, and they forget about the cycles."

— Ray Dalio

Future Outlook and Application

Looking ahead, Dalio's focus on understanding debt cycles, currency dynamics, and geopolitical shifts remains particularly relevant in today's complex global economy. His framework helps investors navigate uncertainty by focusing on timeless principles rather than short-term predictions.

Related Reading: Learn more about portfolio diversification strategies and economic cycle analysis techniques.

Financial analyst with over 15 years of experience in market research, economic cycles, and risk management strategies.

Specializes in portfolio construction, diversification strategies, and understanding historical market patterns.

Credentials: CFA Charterholder, Certified Risk Manager (CRM).

US Stock Market Today: Wall Street Drops as AI Bubble Fears Hit Tech Stocks

Wall Street slipped on Friday as concerns over a potential AI bubble intensified following Broadcom's weaker-than-expected sales forecast.

Long-Term Investors Add Dividend Stocks as Yields Stabilize

Long-term investors are increasing exposure to dividend-paying stocks as Treasury yields stabilize and income-focused strategies regain appeal.

Nike Tops Earnings Forecasts as Holiday Demand Surges

Nike delivered stronger-than-expected quarterly earnings as holiday-season sales and international growth boosted results.

U.S. Consumer Spending Softens as Inflation Pressures Persist

U.S. consumer spending showed signs of slowing as persistent inflation and higher borrowing costs weighed on household budgets.

Board Diversity Remains in Focus as Investors Demand Broader Representation

U.S. investors are renewing calls for greater board diversity, pushing companies to expand representation across gender, ethnicity, and professional background.

about us

Shareholders' Digest is an independent financial news and analysis publication dedicated to shareholders, investors, and market participants. We deliver timely coverage of global markets, corporate earnings, economic trends, and governance issues that shape long-term investment outcomes.

tags

follow

Go To

Top